The most important information briefly:

- What does CBAM stand for and who is affected?

- Which goods are covered and what are the exceptions?

- Which obligations apply from which time period?

- What are the short-term steps that affected companies need to take to prepare?

Overview

CBAM is a newly created system for CO2- cross-border compensation levies of the European Union, which is regulated by the CBAM Regulation [1] and the CBAM Implementing Regulation [2]. In addition, the EU Commission has published guidelines to support the practical implementation of Regulation (EU) 2023/956 (Guidance document on CBAM implementation for importers of goods into the EU [3] and a guidance document on CBAM implementation for installation operators outside the EU [4]).

CBAM is intended to extend the influence of the EU Emissions Trading Scheme (EU ETS), and thus CO2 pricing, to international trade in goods produced outside the EU (especially energy-intensive goods). CBAM also seeks to prevent companies in the EU from being disadvantaged due to stricter emissions regulations and from relocating their production abroad to avoid emissions-related costs.

The underlying idea of CBAM is to impose an additional import levy on CO2-equivalent emissions for imported goods. This levy is calculated based on a fixed reference value for the emissions of the respective goods. After the end of the transition period, importers/later CBAM declarants will have to pay this levy. The CBAM mechanism will already start - albeit gradually - on October 1, 2023.

Goods

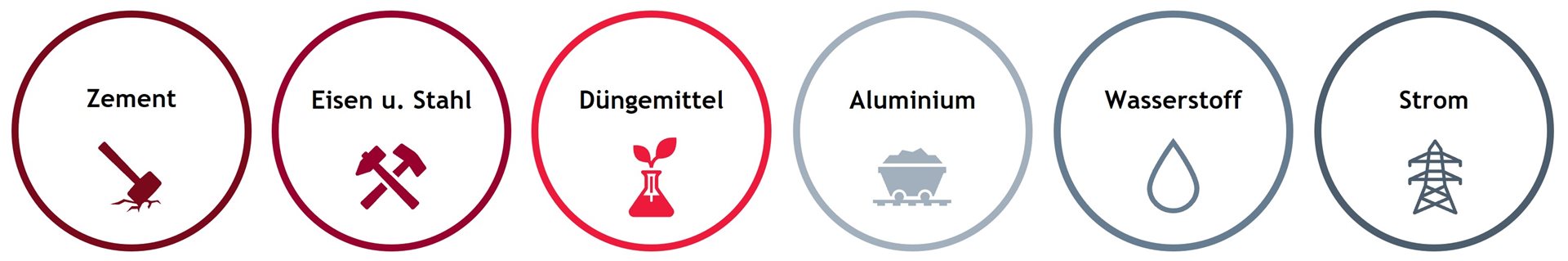

There are currently 6 categories of goods covered by the CBAM. The goods are listed exhaustively in Annex I of the CBAM Regulation.

An expansion to other commodity groups is planned. These will most likely be petroleum, organic chemicals, iron ores and coal.

Exception

Goods are not covered by CBAM if, amongst other factors, they:

- have been manufactured in third countries/territories listed in Annex III (1) of the CBAM Regulation - currently Iceland, Liechtenstein, Norway, Switzerland;/ Büsingen, Helgoland, Livigno, Ceuta and Melilla;

- are to be used or moved for military purposes.

Obligations – Timing

The obligations for importers of CBAM goods will be implemented gradually. The following timeframes should be considered by companies concerned in their planning:

CBAM will start with a transition period on October 1, 2023, lasting until December 31, 2025. During this phase-in period, importers are initially only required to report their greenhouse gas emissions for the first time in a so-called "CBAM report". This report, which must also be submitted in the future, contains:

- Total quantity of each type of goods in MWh for electricity and in tons for all other goods

- Actual total grey emissions in tons of CO2 emissions per MWh for electricity and in tons of CO2 emissions per ton for all other commodities (Annex IV)

- Total indirect emissions (see Implementing Regulation)

- CO2-price in country of origin for grey emissions on production of imported goods

The first quarterly report is due no later than January 31, 2024.

Each CBAM importer must have applied to become an authorised CBAM declarant by December 31, 2025.

On January 1, 2026, the next step occurs - the " arming" of the CBAM mechanism. Non-authorized CBAM declarants will be barred from importing their goods into the EU. Import by others will not be allowed after January 1, 2026.

From that date, "CBAM certificates" must also be acquired and surrendered by authorized CBAM declarants. For this purpose, it must be determined in principle how much gray emissions are generated in the production of the imported goods.

Verification of all embedded emissions by an accredited auditor must also have taken place before the goods are imported.

As of January 1, 2027, a CBAM declaration must be submitted, for the first time by May 31, 2027. This includes the data of the previous calendar year.

Recommendation for action

There are seven particularly important points that companies should take care of or check in the short term:

- Determining whether goods that the company imports are covered by CBAM.

- Importing companies should review their supply chains to determine if their business is affected by CBAM.

- Determine the impact of CBAM on the company's costs and profits.

- Organize cooperation with suppliers from third countries, collecting and verifying emissions data.

- Identify suppliers of goods with lower CO2 emissions and adapt/re-enter into contracts.

- Determine procedure for fulfilling reporting obligations and identify responsible persons.

- Preparation of CBAM report: First reporting obligation 31 January 2024!

Please do not hesitate to contact us! Our interdisciplinary teams will help you to implement all requirements!

[1] Regulation (EU) 2023/956 of the European Parliament and of the Council of 10 May 2023 establishing a carbon border adjustment mechanism, English Version and links to other languages/formats: EUR-Lex - 32023R0956 - EN - EUR-Lex (europa.eu)

[2] Commission Implementing Regulation regarding reporting requirements for the purposes of the Carbon border adjustment system (CBAM) during the transition period between Oct. 31, 2023 and Dec. 31, 2025, on the Internet: EUR-Lex - 32023R1773 - EN - EUR-Lex (europa.eu)

[3] https://taxation-customs.ec.europa.eu/system/files/2023-08/CBAM%20Guidance_EU%20importers_0.pdf

[4] https://taxation-customs.ec.europa.eu/system/files/2023-08/CBAM%20Guidance_non-EU%20installations.pdf